This blog was a collaboration between Teppei Tsutsui, Yasushi Komori, Patrick Montague, and Yuhan Ma of GFR Fund.

As we head into 2026, the venture market is cautiously turning a corner, but not snapping back.

Capital is moving again, innovation cycles are accelerating, and AI continues to reshape what small teams can build. At the same time, higher interest rates, election-year volatility, and shifting consumer trust dynamics mean founders and investors alike must stay disciplined.

Here’s how we’re thinking about the market, AI’s evolution, and what matters most for builders in the year ahead.

Market environment & funding outlook

Incremental recovery, structural discipline

The venture environment entering 2026 feels marginally healthier than a year ago, but not meaningfully easier. Capital is flowing more consistently, yet founders should not expect a return to the zero-rate, growth-at-all-costs era.

Interest rates are likely to remain above 3% through year-end, even with one to two anticipated Fed cuts. Markets currently price a modest decline from roughly 3.5–3.75% to the 3–3.5% range.

While directionally positive, these levels still represent the highest interest-rate environment founders have faced in 10–15 years, continuing to pressure valuations, fundraising timelines, and risk appetite.

That said, signs of liquidity are beginning to re-emerge. The IPO market is slowly reopening, with increased exploratory activity across technology leaders. Discord has reportedly filed confidential IPO paperwork, while OpenAI and SpaceX are both rumored to be in early conversations with banks.

These signals matter less for near-term exits and more for restoring long-term confidence in the venture-backed ecosystem.

On the M&A side, AI continues to drive momentum. xAI’s massive late-stage raise, along with billion-dollar acquisitions by incumbents like Meta and ServiceNow, reinforce that strategic buyers are actively consolidating AI capabilities even as public markets remain selective.

The website interface of Grok, an AI-powered assistant developed by xAI | Cr. Rokas - stock.adobe.com

Overlaying all of this is election-year volatility, which historically introduces short-term uncertainty across public and private markets alike. Against that backdrop, durability, capital efficiency, and clarity of value creation matter more than ever.

From horizontal platforms to vertical communities

Why trust and intent now outperform scale

One of the most important structural shifts we’re watching is the move away from broad, horizontal platforms toward vertically integrated, interest-driven networks.

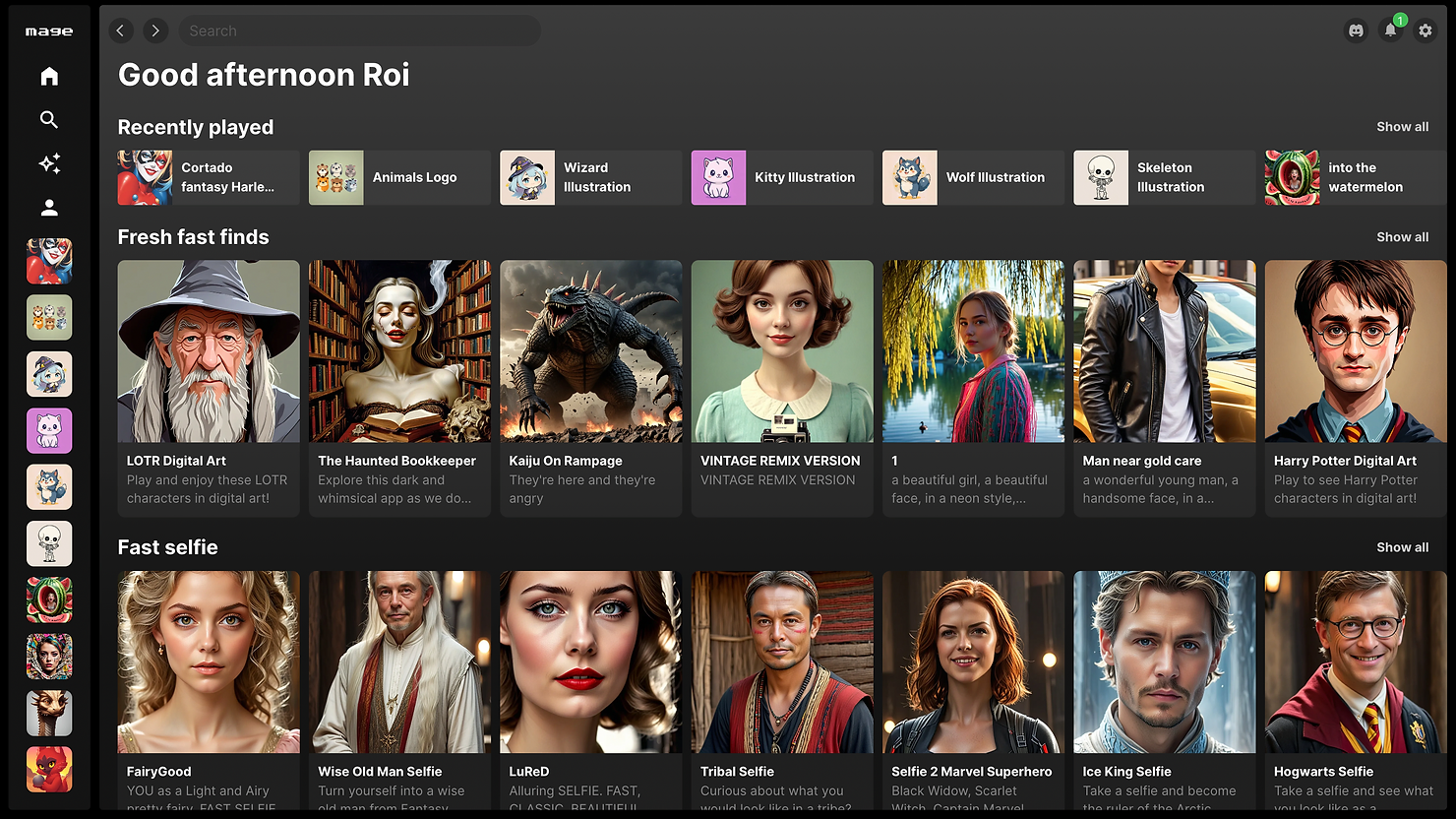

Legacy social platforms, built around scale, feeds, and advertising, are increasingly challenged by declining trust and signal dilution. In contrast, platforms like Discord and Substack are thriving by organizing users around shared intent, identity, and participation rather than pure reach.

In a lower-trust internet, users gravitate toward smaller, more relevant communities where incentives feel aligned and contributions feel meaningful.

This shift has profound implications for how consumer products are built, distributed, and monetized, and it reinforces GFR’s long-standing belief that community is not a feature, but a core competitive advantage.

AI market evolution & opportunities

Smaller teams, broader impact

AI adoption is expanding well beyond entertainment and experimentation. We’re now seeing meaningful traction across industrial, health, and workflow-driven use cases, often built by teams that would not have been viable just a few years ago.

AI-powered development tools are dramatically reducing build costs, enabling two- to three-person teams to ship products that once required entire engineering organizations. The result is a new generation of startups with higher revenue per employee, faster iteration cycles, and tighter feedback loops.

Generative AI content has also crossed an important cultural threshold. AI-assisted creative work is no longer niche or taboo. It’s becoming normalized. One example is how a fully AI-generated comic series topped No.1 on the largest Japanese digital comic platform. We’re seeing a hybrid creative model emerge: human storytelling and taste layered with AI-accelerated production.

That said, meaningful constraints remain. Speed, cost, and quality tradeoffs still limit mass adoption, particularly for free or consumer-scale offerings. Most companies cannot yet offer AI services at zero marginal cost without eroding margins. We believe it will take another four to five years for infrastructure, pricing, and performance to unlock truly ubiquitous AI access.

Investment strategy & founder takeaways

What matters in 2026

Our investment lens continues to favor small, highly technical teams using AI as a force multiplier: companies that simply could not exist without today’s tools.

At the same time, distribution remains the hardest problem. AI can dramatically lower the cost of content creation, but it does not solve trust, discovery, or retention. Community still matters. Reciprocity still matters. Users must feel immediate value for every action they take.

For founders navigating 2026, our advice is straightforward:

- Keep burn rates as low as possible

- Leverage AI aggressively across development and operations

- Build community early, with trust as a first-order principle

- Avoid over-reliance on paid acquisition channels (learn more in this blog)

In this environment, discipline compounds. Teams that build efficiently, earn trust, and align incentives with their users will be best positioned not just to survive this cycle, but to define the next one.

If you're an investor or LP looking for partnership opportunities, reach out to us at hello@gfrfund.com. For startups, please pitch to us by filling out this form. We'd love to hear from you!

%20(1)-1.jpeg)