Venture capitalists are increasingly drawn to startups leveraging generative AI to tackle real-world problems, from gaming, digital media, and consumer tech to healthcare and finance. As a result, a new frontier is unfolding in the VC landscape, where the potential of generative AI is actively explored. This blog delves into the trend of generative AI from a VC perspective and discusses the investment strategy around it.

Why generative AI matters for venture capitalists

Generative AI matters for venture capitalists due to its unique ability to disrupt markets and redefine industry standards. Generative AI possesses the power to create, innovate, and adapt on its own. This autonomy creates a competitive advantage for startups applying generative AI to their products and services.

Moreover, the scalability of generative AI technologies adds another layer of attractiveness for venture capital investment. As startups develop and refine their generative AI models, the potential for widespread adoption and market penetration becomes increasingly evident. The scalability and versatility makes such startups prime candidates for strategic investment and long-term growth.

Key investment criteria for generative AI startups

Making wise investment decisions in generative AI requires a strategic approach. Various aspects can contribute to long-term success. Venture capitalists should consider these key factors when evaluating startups in this dynamic space.

1. Quality of the founding team

The backbone of any startup's success, especially in the nuanced field of generative AI, is the founding team. A strong team has a deep understanding of machine learning, technical scalability, and optimizing GPU usage. The team must be able to fine-tune its model according to the very complex requirement of the generative AI applications.

2. Market potential and use cases

Venture capitalists seek startups with a keen understanding of their market potential. How does the startup apply generative AI to the existing market? And how does it create new experiences? Venture capitalists look into the startup’s ability of not only automating processes but also creating an undefined market or experience.

3. Ethical considerations

Ethical implications are paramount in the evaluation process. How does the startup address ethical concerns related to content generation, privacy, and potential misuse of the technology? A commitment to responsible and ethical practices is a non-negotiable criterion for investment.

4. Regulatory awareness

Given the evolving nature of AI regulations, venture capitalists prioritize startups with a comprehensive understanding of regulatory frameworks. How well-prepared is the startup to navigate and comply with existing and potential future regulations, such as intellectual property (IP) and copyright issues?

Generative AI startups success stories and use cases

GFR has been working on broadening its portfolio with startups showcasing the transformative influence of Generative AI. One of them is 1337, a startup leveraging generative AI to build a community of AI-driven micro-influencers.

The micro-influencers are content creators with hyper-personalized interests and diverse backgrounds. They want to connect to people from niche communities like gardening, emo music, vintage fashion, classical literature, and more. Their content is created and designed by the 1337 team in collaboration with users and AI models. These models include OpenAI’s GPT-4 (for written captions), Midjourney (art), and 1337’s in-house solution.

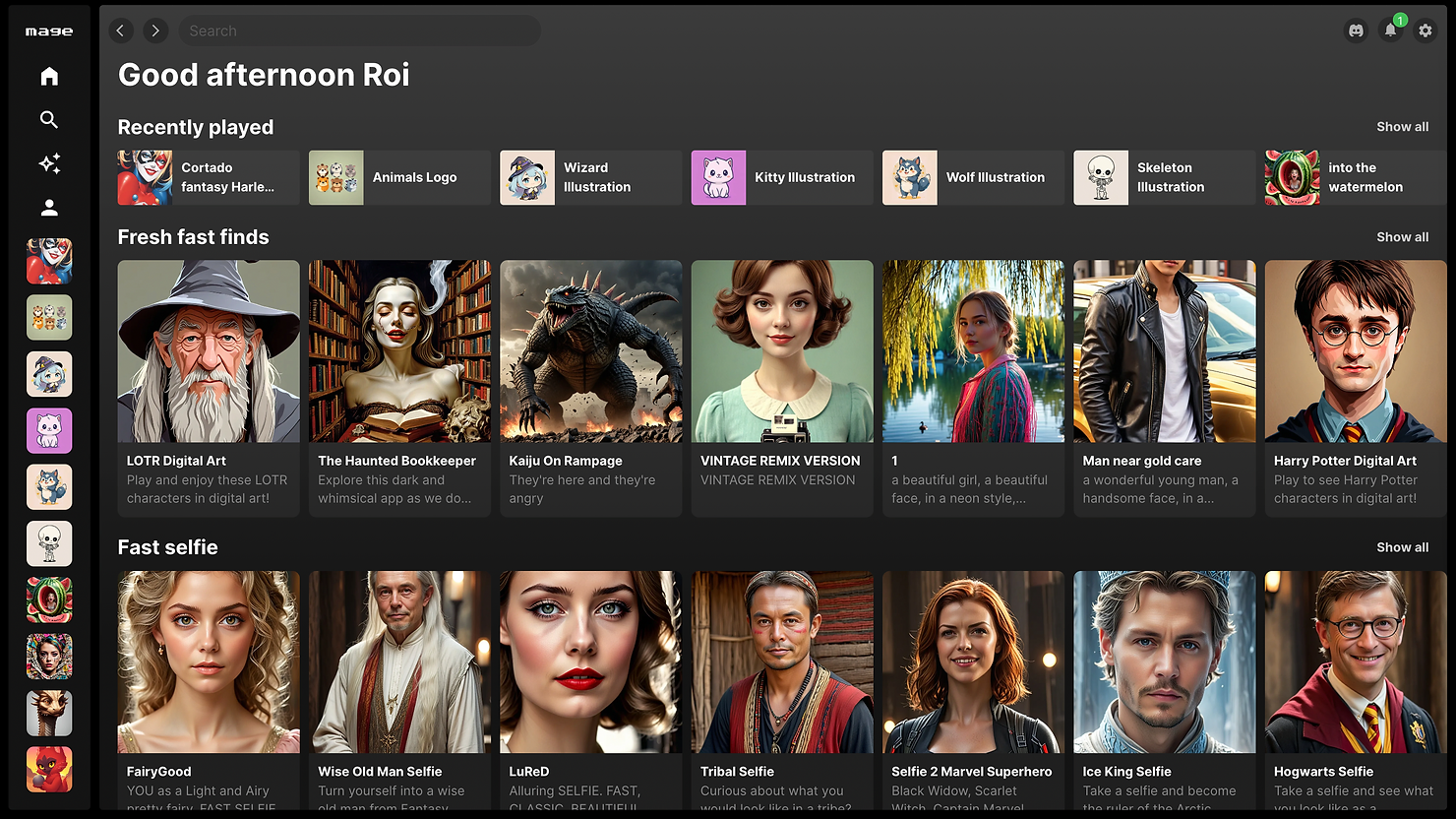

Generative AI has offered new possibilities to the art and creative space. Mage is a platform that allows users to generate images, videos, and 3D scenes using various fine-tuned AI models. Its versatile AI empowers creativity for concept artists, graphic designers, writers, social media creators, and more communities.

In addition, Yodayo is an AI-native social network created for VTubers and anime fans to share and create content. Users can post text, images, videos, and more to their feeds. They can also engage and connect with other users through the platform's social features.

Challenges and collaborative investment strategies in generative AI investments

The promise of generative AI is captivating. But it's essential to acknowledge the challenges and potential risks associated with investing. These can include regulatory uncertainty, ethical considerations, technical hurdles, market acceptance, data security, etc.

That being said, to maximize impact and mitigate risks, collaborative investment strategies emerge as a compelling approach. These strategies can be building strategic partnerships, co-investing, industry-academia collaboration, or creating knowledge exchange platforms to share insights, challenges, and solutions.

Join us in shaping the future of generative AI

Here at GFR Fund, we envision a future where generative AI transforms industries and enriches human experiences. With a commitment to responsible innovation, we seek to support startups that not only demonstrate technological prowess but also align with ethical considerations.

We invite startups, VCs, and LPs to join us on this collective journey and shape a future where the generative AI landscape transcends boundaries and creates lasting impact.

Reach out to us at hello@gfrfund.com or pitch to us by filling out this form!