Q3 2024 signals a shift in the venture capital landscape. After months of uncertainty and declining activity, the market is showing early signs of stabilizing. Drawing insights from the CB Insights State of Venture Q3'24 Report, we will walk you through global and US venture funding trends, leading sectors, the emergence of new unicorns, and exit trends.

Additionally, expert opinion from our General Partner, Yasushi Komori, offers valuable insights into the current market sentiment and future outlook.

Global funding overview

1. Funding decline

In Q3 2024, global venture capital funding reached $54.7 billion across 6,056 deals. This marks a decrease in funding compared to Q2 2024 ($68.1 billion). Overall, the global deal count continues to decline from its peak in 2021, when quarterly deals regularly surpassed 10,000. The US remained the leading region, accounting for 36% of all global deals.

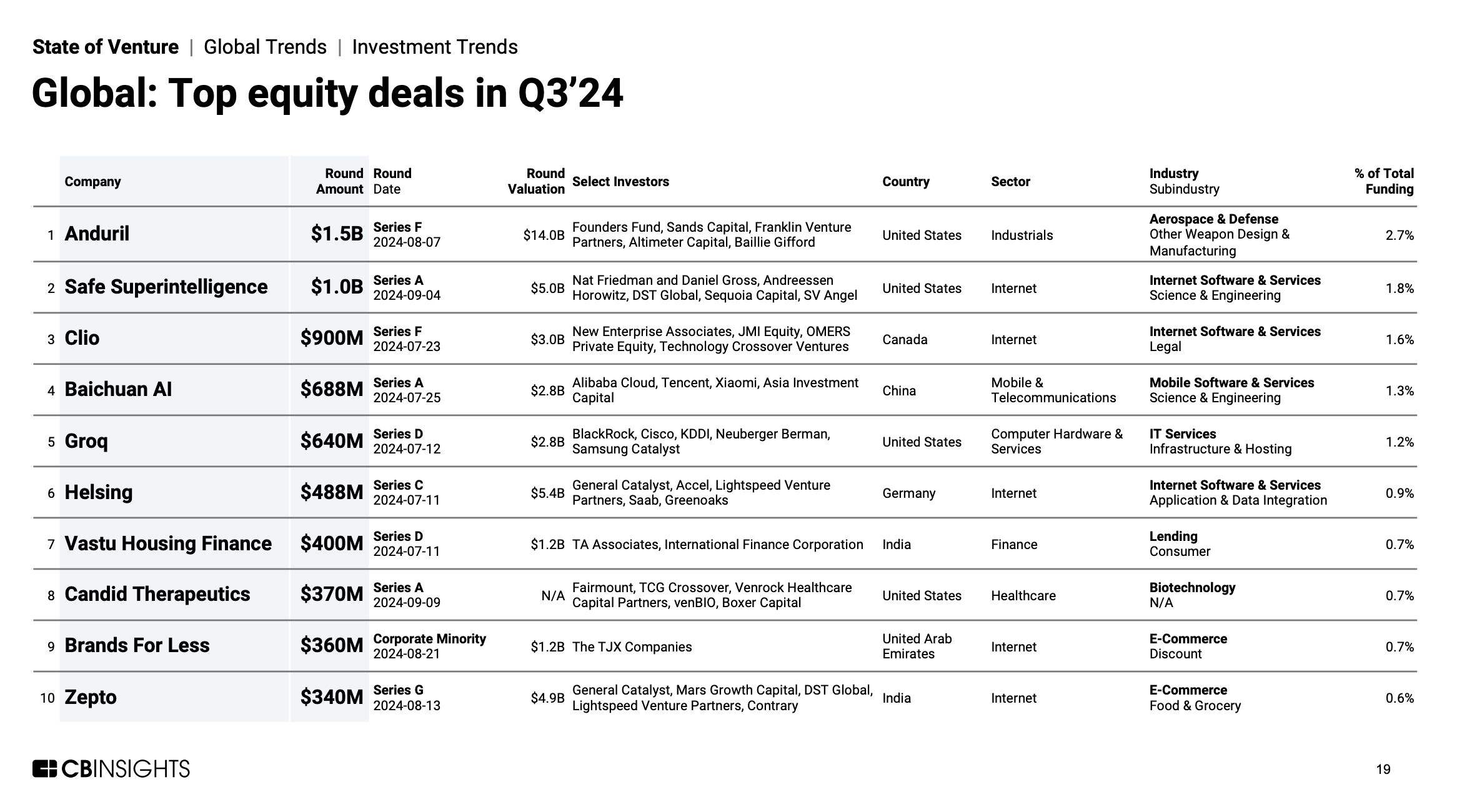

2. Aerospace and defense among leading sectors

The top-funded sectors in Q3 2024 were dominated by aerospace and defense, driven by significant rounds like Anduril’s $1.5 billion Series F. Other notable sectors include internet software and services, which attracted major investments, reflecting the increasing demand for AI and software-driven solutions globally.

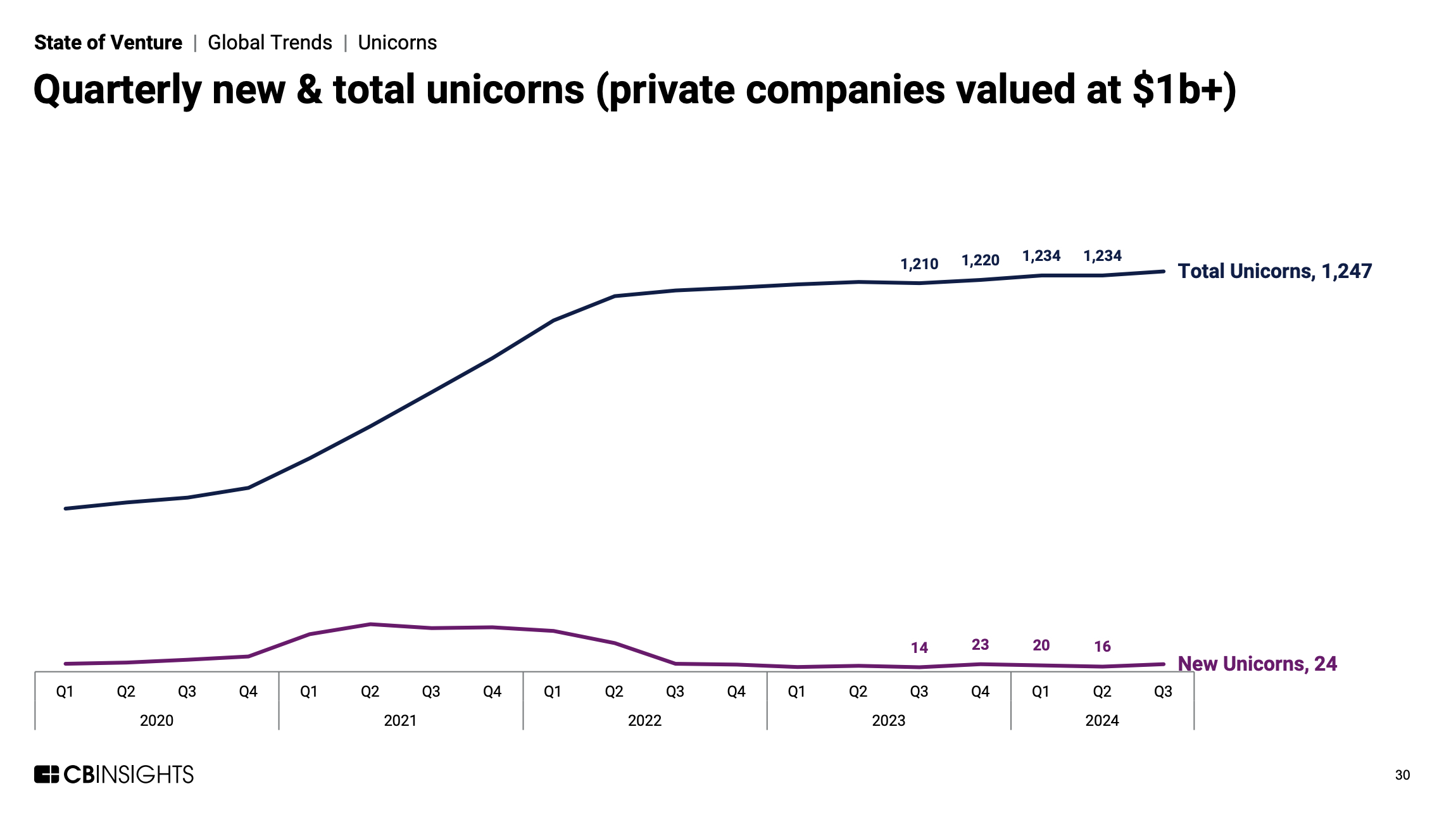

3. Emergence of new unicorns

24 new unicorns were born globally in this quarter, raising the total number of unicorns to 1,247. The US led in unicorn births with 17 new entries, followed by Asia with 4 and Europe with 3. Notable new unicorns include Safe Superintelligence and Story Protocol in the US, valued at $5 and $2.3 billion, and SemiDrive in China, valued at $1.9 billion.

4. Exits increased modestly

Global exits, including IPOs, M&A, and SPAC deals, totaled 2,156 in Q3 2024. The total number of exits saw a modest increase from Q2. IPO activity, specifically, remained sluggish, with only 72 IPOs globally, as market conditions continued to challenge public market entries.

US funding overview

1. Fewer but larger deals

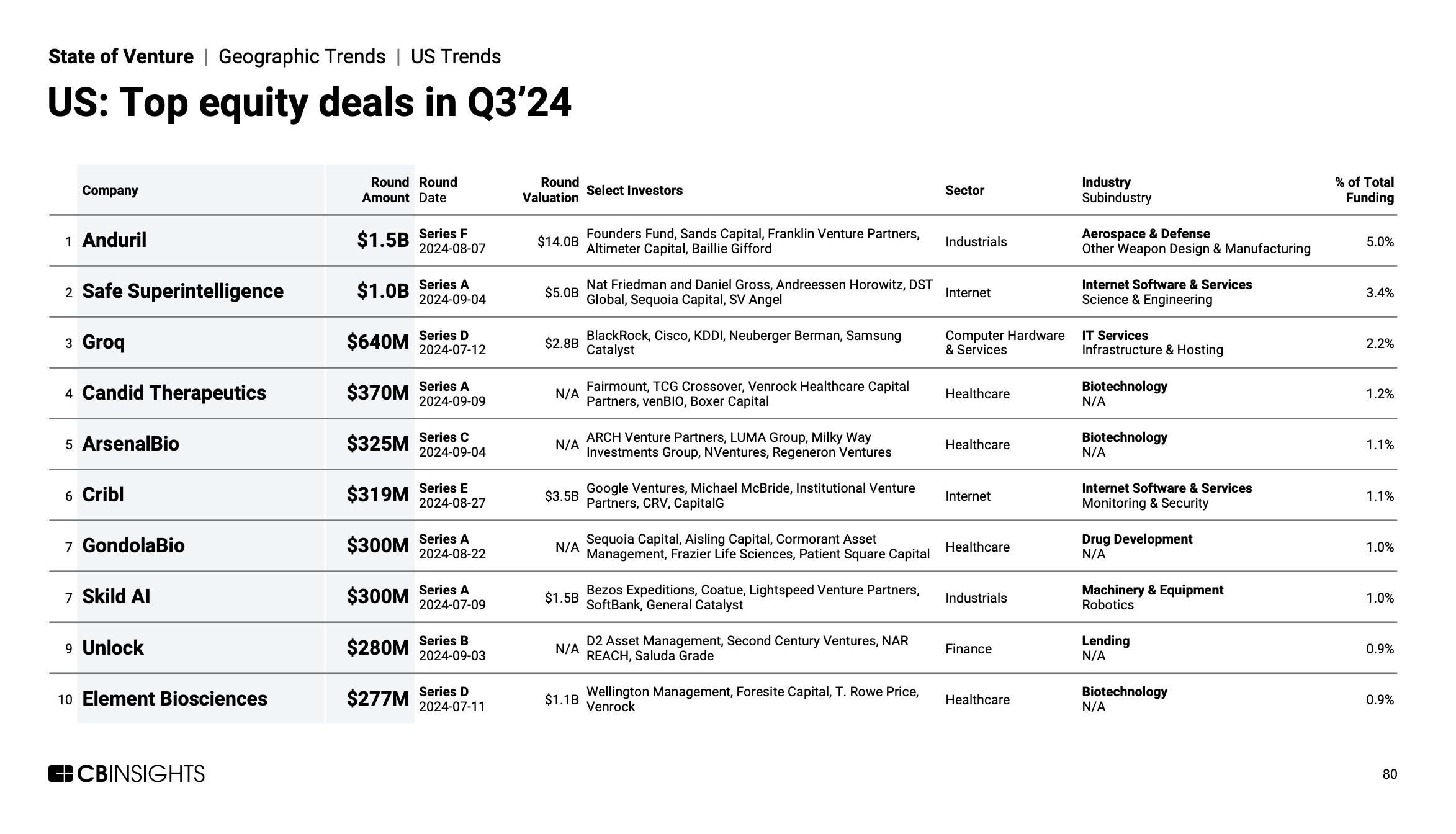

The US maintained its position as the largest venture capital market, with $29.8 billion in funding across 2,176 deals in Q3 2024. Deal volume continues to decline, reflecting a global trend of fewer but larger investments.

2. Early-stage dominates

Early-stage deals dominated the US market, representing 63% of all deals, while mid-stage deals accounted for 11%, and late-stage deals made up 7%.

3. Significant deals

Key deals in the US included:

- Anduril: $1.5 billion Series F (Aerospace & Defense)

- Safe Superintelligence: $1 billion Series A (Internet Software & Services)

- Groq: $640 million Series D (Computer Hardware & Services)

Expert opinion by Yasushi Komori

Valuations have stabilized

While we are not seeing a strong rebound in valuations, it appears that the sharp declines in valuations that began in 2022 have tapered off, and we are now entering a phase of stabilization. Valuations may remain flat for the near term, but they are unlikely to drop further, giving investors and founders a more predictable landscape.

Interest rate cut a key turning point

The recent interest rate cut by 0.5% in September is perhaps the most significant driver of future recovery. With borrowing costs now lower, the pressure on startups and growth companies will ease, making it easier to raise capital and invest in expansion. Lower interest rates typically lead to increased liquidity in the market, which could reignite venture activity across all stages. This move by central banks signals their intention to stimulate economic growth, which will likely translate to increased investor confidence.

Stock market performance signals broader confidence

The S&P 500 reaching a new record high this quarter is another critical indicator. This reflects broader market confidence, which typically correlates with venture capital trends. When the public markets are doing well, private market valuations tend to follow, as investors feel more confident in taking risks. Strong stock market performance also increases the likelihood of IPOs, providing much-needed exits for investors and signaling positive returns down the road.

Expectations for 2025

Taken together, these factors point to 2025 as a year of recovery for venture funding. As interest rates remain low and stock markets continue to perform well, the venture ecosystem is expected to benefit from improved capital flow. While deal volume and valuations have bottomed out, we are likely to see gradual growth as both startups and investors regain confidence. This could lead to an uptick in both early-stage deals and late-stage exits.

However, it’s noteworthy that next month's upcoming presidential election introduces a layer of uncertainty. Potential policy shifts that could impact investor confidence and market stability. A key factor to watch will be whether Lina Khan remains the head of the Federal Trade Commission (FTC), as any leadership changes could influence the regulatory landscape for tech companies and startups. As we approach 2025, these political dynamics will play a crucial role in shaping the venture capital ecosystem’s trajectory.

Conclusion

The Q3 2024 report suggests that the worst of the downturn is behind us. With stabilizing valuations, lower interest rates, and a strong stock market, the stage is set for a market recovery in 2025. At GFR, we are prepared for an improved funding environment as economic conditions continue to favor growth and innovation. In the meantime, while optimism is growing, the outcome of upcoming political events will be critical in determining the speed and strength of the recovery.

If you're an investor or LP looking for partnership opportunities, reach out to us at hello@gfrfund.com. For startups, please pitch to us by filling out this form. We'd love to hear from you!