In the world of venture capital, some of the most impactful work happens not on the frontlines of deal-making but at the intersection of trust, alignment, and long-term partnership.

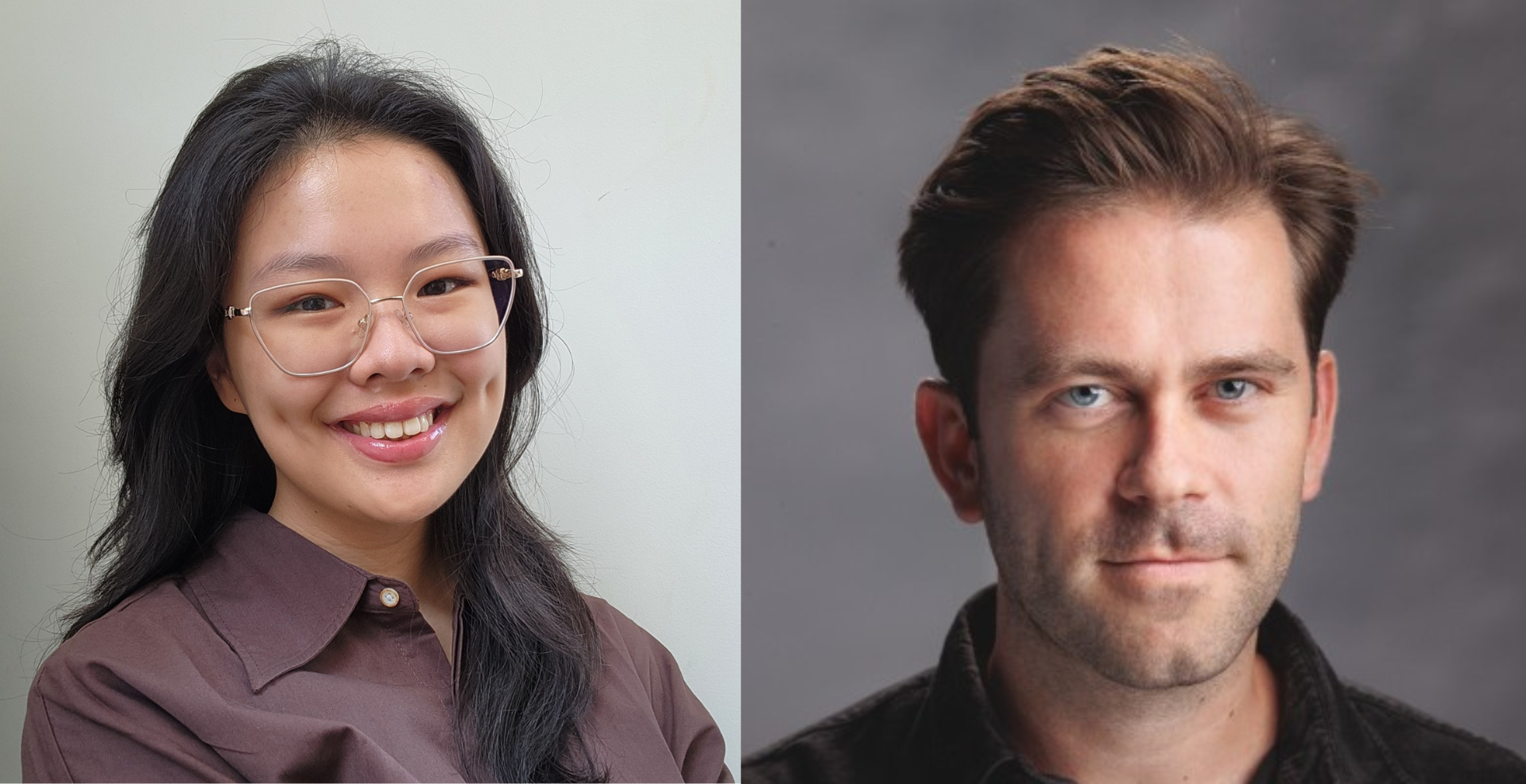

Youngrok Kim, who leads the GREE LP Fund (GLF), sits squarely at that intersection. GLF is a "sister fund" to GFR, with both funds sharing a common anchor LP. From engineering at Goldman Sachs in Tokyo to building fund-of-funds strategies that connect leading GPs with sophisticated LPs, Youngrok brings a rare dual lens shaped by both direct investing and fund strategy.

In this conversation, he reflects on what drew him to the LP side of venture, how GFR Fund stands out in its approach to LP engagement, and what the future holds for a new generation of LP-GP relationships, plus a few personal favorites to round things off.

You’ve worked extensively with LPs across different fund cycles and geographies. What first drew you to this side of venture capital?

My career began as an engineer at Goldman Sachs in Tokyo back in 2009—a pivotal year in the tech ecosystem when transformative companies like Uber and venture firms like Andreessen Horowitz emerged. Observing these groundbreaking innovations from afar, I felt an intense desire to be directly involved in the excitement unfolding in Silicon Valley.

In pursuit of this aspiration, I relocated to the United States in 2015 and joined ARCH Venture Partners as an associate. There, I gained invaluable experience in direct investing, which eventually led to a role overseeing both fund and direct investments at Recruit’s corporate venture capital arm.

Through this journey, I discovered a strong passion and strategic advantage in fund investments, compelling me to establish my own fund-of-funds. My vision aligned perfectly with GREE, where I now lead the GREE LP Fund, bridging opportunities between exceptional general partners and sophisticated limited partners.

What unique insights have you gained from sitting at the intersection of GPs and LPs?

Having begun my venture capital journey as a direct investor, I naturally understand the nuances of the general partner perspective, particularly their operational challenges and strategic considerations. This foundational GP mindset enables me to deeply appreciate and evaluate opportunities effectively. Moreover, it significantly enhances my ability to foster trusting, mutually beneficial relationships with both GPs and LPs, creating a bridge that enhances collaboration and alignment.

Youngrok speaking at the KOREAN in Silicon Valley event in 2024

From your experience, what do LPs value most in their relationships with venture funds like GFR?

Above all, LPs prioritize strong financial performance, especially realized returns, exemplified by Distributed to Paid-In capital (DPI). GFR Fund excels in delivering exceptional returns, not just in paper numbers (TVPI), but in actual distributions (DPI).

Furthermore, LPs highly value GFR’s strategic sector focus on media, gaming, and digital culture. As disposable incomes and leisure time continue to rise globally, I believe innovations in these sectors will profoundly shape consumer behavior and market dynamics.

Additionally, GFR’s deep ties to the Japanese market offer unique insights and differentiated access, positioning the fund distinctively in capturing cultural and market opportunities from this influential region.

Lastly, rather than managing a broad, impersonal investor base, GFR strategically maintains a selective, tightly-knit LP community, allowing tailored engagement, bespoke communication, and active involvement of LPs in the investment lifecycle, fostering deeper trust and collaboration.

How does GFR communicate with and involve its LPs beyond capital?

Beyond traditional quarterly reporting, GFR sends monthly updates to enhance the transparency of the fund's activities. We prioritize proactive transparency, engaging the LPs with timely insights about emerging trends, portfolio company progress, and strategic fund decisions. GFR's commitment ensures LPs feel continuously informed and involved, reinforcing their confidence and partnership.

GFR actively engages LPs beyond capital contributions by facilitating strategic co-investment opportunities, exclusive networking events with portfolio companies and other LPs, and tailored introductions designed to amplify the strategic value for LPs' broader investment goals.

GFR's LP base includes many other influential players in Japan, which could provide strong value to its portfolio companies. Through these initiatives, GFR enables LPs to directly leverage their ecosystem, accessing curated deal flows and partnerships that align closely with their individual strategic priorities.

What types of LPs do you think are the best fit for GFR Fund?

Ideal LPs for GFR are those seeking exceptional returns and unique strategic insights in digital culture, gaming, and media industries. They are typically sophisticated investors who recognize the long-term transformative potential of these sectors and who actively seek differentiated perspectives and access points, particularly through specialized, regionally connected expertise.

What advice would you give to LPs looking to build stronger partnerships with their GPs?

A decade ago, venture capital witnessed a shift toward value-added investment, where providing strategic support beyond capital became essential rather than optional.

Today, this principle extends to LPs as well. My advice is for LPs to proactively identify and articulate the unique value they can offer their GPs. Actively contributing value beyond capital significantly strengthens trust and deepens the relationship between LPs and GPs.

What do you think the next generation of LP-GP relationships will look like—and how is GFR preparing for it?

The next generation of LP-GP relationships will be characterized by increased collaboration, transparency, and strategic integration, with LPs becoming active ecosystem participants rather than passive investors.

GFR is already ahead of this curve, proactively nurturing close-knit relationships through personalized engagement, fostering co-investment opportunities, and maintaining strategic alignment with a limited number of LPs. This positions GFR to effectively adapt and thrive as these relationships evolve.

To wrap up this interview on a high note, how to act like a wine expert when you know nothing about what you're drinking?

Just confidently swirl the glass, give a thoughtful sniff, and remark, “Hmm, I smell the earth!” It always works.

And lastly...who's your favorite Kpop group/artist and why?

I have tremendous respect for BoA. As a pioneering figure among K-pop artists who achieved remarkable success in Japan, she paved the way for subsequent generations' international careers. Her bold move to Japan in 2001—one year before I moved there myself—inspired me greatly. Witnessing her triumph abroad gave me the courage and motivation to pursue my own dreams internationally, and I continue to admire her trailblazing spirit.

BoA's Japanese debut single cover image | SM Entertainment

%20(1).jpg)