Venture capital funding held strong in Q2 2025, crossing the $90B mark for the third straight quarter. While the number of deals dropped to their lowest level since Q4 2016, the size and ambition of funded companies continued to climb. Here’s a breakdown of the key trends we’re watching:

Funding remains robust, but deal volume drops

VCs deployed $94.6B globally across 6,028 deals this quarter. That’s a 9% drop in deal count from Q1, continuing the trend of fewer, larger bets. Median deal size reached a new high of $3.5M, suggesting investors are concentrating capital into more mature or promising ventures.

In the U.S., funding totaled $68.7B across 2,430 deals, once again leading global activity. Asia followed with $9.0B, while Europe raised $13.8B.

Hard tech grabs the spotlight

Six of the 10 largest deals in Q2 went to hard tech companies, including:

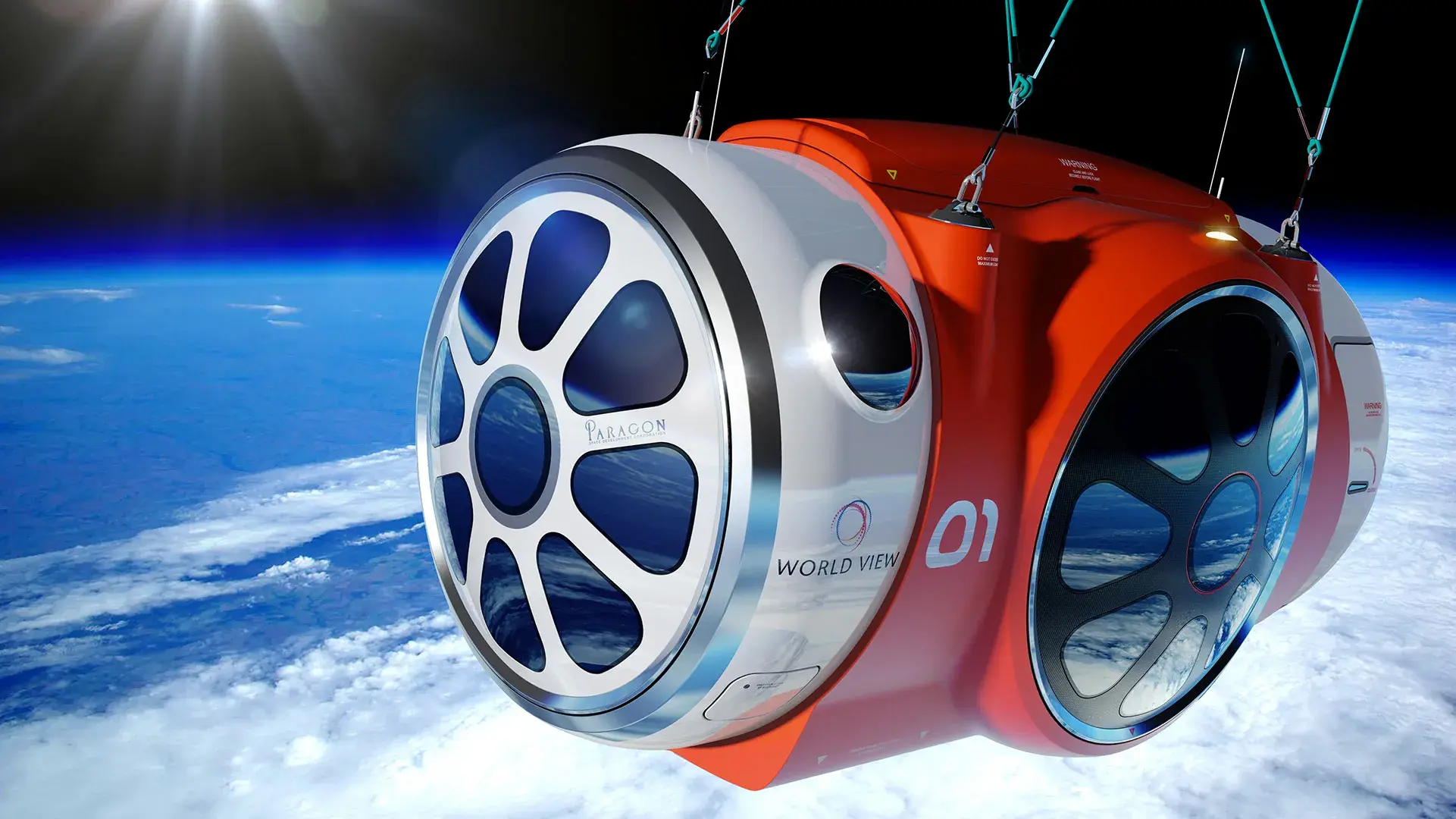

- World View – $2.6B (Series E)

- Anduril – $2.5B (Series G)

- Montera Infrastructure – $1.5B (Undisclosed)

From aerospace and defense to energy infrastructure, capital is flowing into tech with tangible impact. The resurgence of deep tech and defense-backed innovation is likely to define the next chapter of venture.

AI startups still in the lead

AI funding reached $47.3B across 1,403 deals — nearly 50% of all venture funding this quarter. The median deal size for AI startups hit $4.6M, well above the market average.

Notable AI-related deals include:

- xAI – $5.0B (Series D)

- Thinking Machines Lab – $2.0B (Seed)

- Anysphere – $900M (Series C)

As AI continues to evolve from foundational models to infrastructure and vertical applications, investors are paying a premium for companies with strong teams, deep moats, or specialized focus.

Mega-rounds are driving the market

Deals over $100M accounted for 61% of all VC funding this quarter, totaling $57.4B across 156 mega-rounds. The average mega-round now significantly shapes not only funding trends but also exit expectations and valuations.

Companies like Scale AI ($14.8B corporate round from Meta) and Neuralink ($650M Series E) reflect the scale and intensity of capital deployment among AI and frontier tech leaders.

CVC activity hits 7-year low

Corporate VC deal count dropped to 742, the lowest in over seven years — down 8% from Q1. Interestingly, the median CVC deal size was the highest since 2021, and 32% of CVC deals involved three or more CVCs, suggesting that syndicates are forming to meet the capital demands of large infrastructure plays and AI innovation.

Exit market remains tepid — except in AI

Overall exit activity stayed muted, with 85 IPOs and 2,053 M&A deals globally. However, AI M&A bucked the trend, reaching a record high, as big tech prioritized minority investments and AI capabilities over outright acquisitions — a pivot likely influenced by growing antitrust scrutiny.

Unicorn count creeps up

Q2 saw the birth of 32 new unicorns, bringing the global total to 1,285. The most notable new entrants include:

- Thinking Machines Lab ($10B valuation)

- CHAOS Industries ($2B)

- Kalshi ($2B)

- Tailscale (Canada, $1.5B)

Early-stage mega-rounds, like Thinking Machines’ $2.0B seed round, are blurring traditional funding stage definitions — a signal that the most promising technical teams can now raise at growth-stage valuations out of the gate.

What we’re watching

- Defense and aerospace: Continued surge in dual-use technology and national security-aligned ventures.

- AI infrastructure: The next wave of picks-and-shovels companies serving developers and enterprises.

- VC consolidation: Fewer deals, but larger checks, and a clear separation between top-decile startups and the rest.

- Global capital shifts: U.S. dominance continues, but regions like Europe and Asia are gaining ground in specialized sectors (e.g., robotics, renewables).

Final thoughts

Q2 2025 marks a period of selective acceleration in the VC market. While deal activity has cooled, capital continues to flow into transformational sectors, such as AI, hard tech, and energy. In this environment, the bar is higher — but so is the upside.

At GFR, we remain excited about the builders navigating the edge of what’s next, and we’re staying curious and convicted as we look toward H2 2025.

If you're an investor or LP looking for partnership opportunities, reach out to us at hello@gfrfund.com. For startups, please pitch to us by filling out this form. We'd love to hear from you!