The venture capital landscape in Q2 2024 reveals a complex and evolving environment. Drawing insights from the CB Insights State of Venture Q2'24 Report, we will walk you through global and US venture funding trends, leading sectors, the emergence of new unicorns, and exit trends.

Additionally, expert opinion from our Venture Partner, Patrick Montague, offers valuable insights into the current market sentiment and future outlook.

Global funding overview

1. Total funding and deals

In Q2 2024, global venture funding increased 8% quarter-over-quarter to $65.7 billion, despite a decrease in deal volume for the ninth consecutive quarter, totaling 6,230 deals. This marks a significant decrease in deal volume compared to the peak in Q1 2022.

2. Leading sectors

AI startups dominated, capturing 28% of all VC funding, a record high, with $18.3 billion invested. Significant investments included $1 billion+ deals for companies like Elon Musk's xAI, Scale, and CoreWeave. Other strong sectors included fintech, retail tech, and digital health.

3. Emergence of new unicorns

Q2 2024 saw the creation of 14 new unicorns, bringing the global total to 1,239. The US led with 12 new unicorns, including xAI and Monad, followed by Europe with 2.

4. Exit trends

The US and Europe each accounted for 39% of global exits, with notable IPOs from Tempus and Rubrik. Major M&A deals included Hyundai's acquisition of Motional for $4.1 billion and TPG Capital’s acquisition of Aareon for $4.2 billion.

US funding overview

1. Overall funding

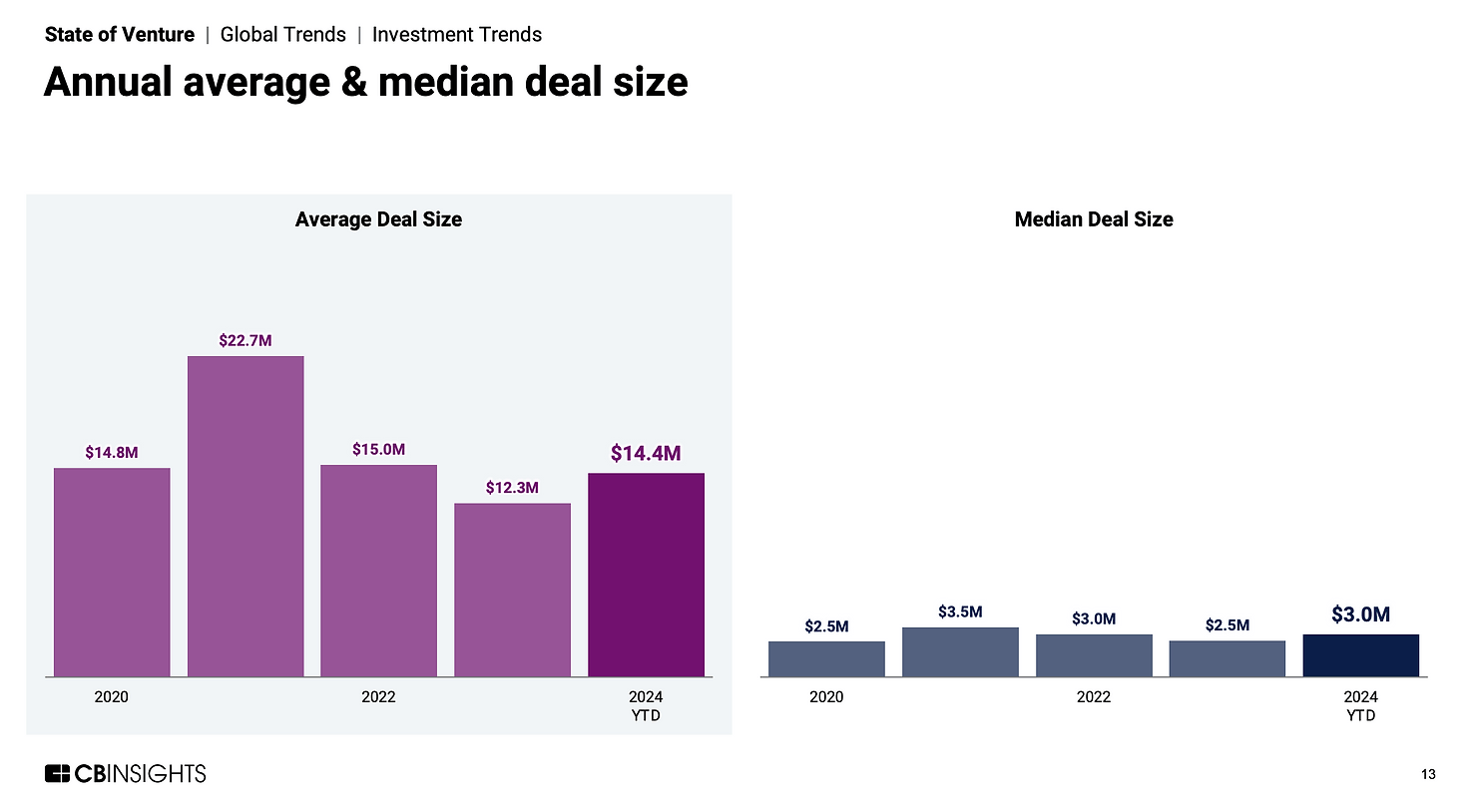

US venture funding reached $39.0 billion in Q2 2024 across 2,419 deals. The average deal size increased to $14.4 million, reflecting a 17% year-over-year growth.

2. Deal stages

Early-stage deals constituted 62% of total deals of 2024 up-to-date, while mid-stage and late-stage deals represented 11% and 7%, respectively. Noteworthy deals included xAI's $6 billion Series B and CoreWeave's $1.1 billion Series C.

3. Significant deals

Top US deals in Q2 2024 featured xAI's $6 billion Series B, CoreWeave's $1.1 billion Series C, and Scale's $1 billion Series F. Other significant investments included Stripe's $694 million Series I and AlphaSense's $650 million Series F.

Expert opinion by Patrick Montague

Market sentiment

While we are seeing a gradual trend toward more liquidity across various stages and regions of the VC landscape, the overall numbers are somewhat dubiously buoyed by an increased concentration of investment activity in celebrity teams building in the most buzz-generating categories.

Most prominently, AI-related opportunities continue to experience unprecedented investment levels, with AI startups capturing 28% of all VC funding in Q2 2024. This surge is, in turn, driven largely by massive mega-deals in companies such as xAI, which itself accounts for $6 of the $18.3 billion in AI funds raised during the quarter.

As such, misreading the headline figures might lead to a disjointed fundraising experience for founders in less hyped categories, especially at their most critical funding stages. Indeed, some investors are calling to mind the Series A Crunch of 2012, including Tomasz Tunguz in his recent blog titled "Seedpocalypse."

In such a ‘crunch’ period, an abundance of seed funding creates an imbalance that makes it increasingly difficult for startups to secure their Series A rounds. Will that imbalance resolve at Series A or extend to subsequent Series B rounds in the near future?

Long-term outlook

Given these current dynamics, rife with somewhat countervailing forces, we find at GFR that focusing on our core competencies and niche networks remains the most critical.

Regardless of whether a space is currently generating the most headlines, strongly differentiated products that solve unmet needs or serve underappreciated communities will continue attracting investment interest.

And while temporal crunch-like conditions may exist at certain stages, they do not persist by definition. Responsible investors have many tools at their disposal to help founders caught at the wrong stage at the wrong time’ navigate these short-term imbalances.

In the long term, the venture capital funding and exit environment is gradually stabilizing and improving. The highly elastic days of 2021 and 2022 are over but so too are we nearing the end of their sclerotic descendents. While we are certainly still experiencing some dislocations, as evidenced by highly concentrated funding activity, movement is returning.

Disciplined investors who focus on their circle of competence and on their commitment to supporting founders navigate remaining pockets of choppiness should benefit from a more positive outlook returning to the overall venture capital market.

Conclusion

The venture capital landscape in Q2 2024 presents a mixed but promising picture. While AI and other sectors continue to attract significant investments, funding for less-hyped areas remains challenging.

Investors should remain optimistic but focus on core competencies and niche networks. These are vital for navigating this complex environment, ultimately leading to a more stable and positive venture capital outlook.

If you're an investor or LP looking for partnership opportunities, reach out to us at hello@gfrfund.com. For startups, please pitch to us by filling out this form. We'd love to hear from you!