Blog

Featured insights for

Consumer AI

Consumer AI: Where the Market Is Actually Taking Shape

To better understand where consumer AI is actually working today and where it is still early, we spent time speaking with founders building across different layers of the stack. Those conversations form the backbone of our Consumer AI Report (2025–2026), published today.

One clear insight stood out. In consumer and entertainment contexts, AI is rarely the product itself. What ultimately matters is the experience. How AI shows up as an interface, how it enables expression, and how communities form around it. In many categories, differentiation is happening at the UX and community layer rather than through model ownership alone.

Recent Articles

- GFR Fund

- September 23, 2025

Gamescom is where the future of the industry reveals itself. What happens in Cologne often foreshadows where gaming is...

- GFR Fund

- September 2, 2025

We're thrilled to announce our upcoming Office Hour sessions in San Francisco and Los Angeles during the SF & LA Tech...

- GFR Fund

- August 27, 2025

TikTok has quickly become one of the most powerful growth engines for startups. But scaling effectively on the platform...

- GFR Fund

- August 14, 2025

In a digital landscape saturated with fast-paced, competitive experiences, Loftia offers something refreshingly...

- GFR Fund

- July 30, 2025

We're excited to announce our Gamescom 2025 Office Hour, which will take place in Cologne, Germany! As part of our...

- GFR Fund

- July 28, 2025

Venture capital funding held strong in Q2 2025, crossing the $90B mark for the third straight quarter. While the number...

- Brian Takemasa

- July 23, 2025

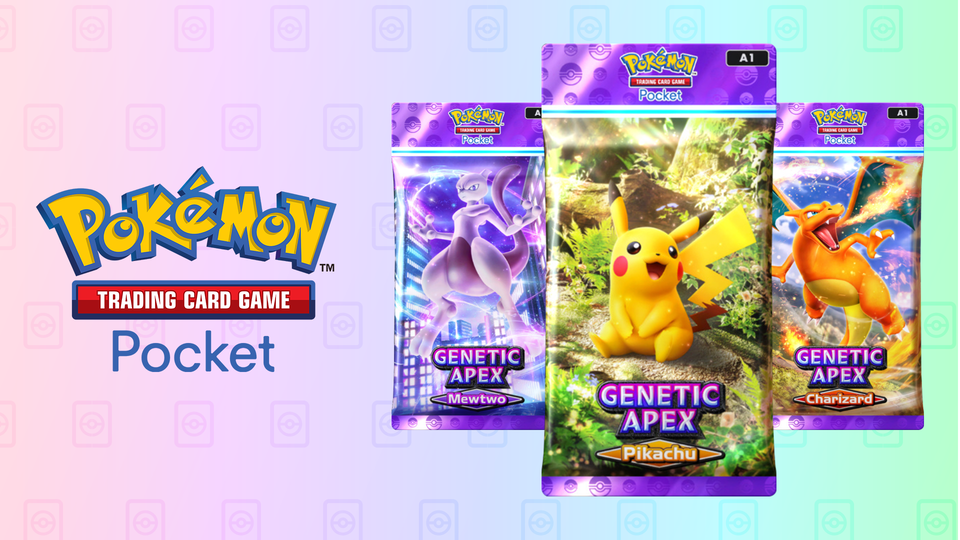

Why should game designers care about Pokémon TCG Pocket?

- GFR Fund

- July 7, 2025

In a world where scrolling never stops and AI-generated content floods our feeds, it’s getting harder to tell what’s...

- GFR Fund

- June 16, 2025

If you’re a game founder trying to raise your first institutional round, you’ve probably been told to “build...

-1.png)

%20(2).png)

%20(1).jpg)