Blog

Featured insights for

Consumer AI

Consumer AI: Where the Market Is Actually Taking Shape

To better understand where consumer AI is actually working today and where it is still early, we spent time speaking with founders building across different layers of the stack. Those conversations form the backbone of our Consumer AI Report (2025–2026), published today.

One clear insight stood out. In consumer and entertainment contexts, AI is rarely the product itself. What ultimately matters is the experience. How AI shows up as an interface, how it enables expression, and how communities form around it. In many categories, differentiation is happening at the UX and community layer rather than through model ownership alone.

Recent Articles

- GFR Fund

- October 30, 2024

Every founder knows the startup journey is a rollercoaster, filled with intense highs and lows. In the midst of scaling...

- GFR Fund

- October 18, 2024

This year, we've hosted a series of successful Office Hours in San Francisco, Los Angeles, New York, and Cologne. We've...

- GFR Fund

- September 16, 2024

When snacking meets gaming, it becomes a fun, competitive experience that engages consumers from children to grown-ups....

- Brian Takemasa

- September 11, 2024

The way we play is changing. The gaming landscape is evolving rapidly, with new trends reshaping various categories in...

- GFR Fund

- September 4, 2024

Following the success of a series of Office Hours held in the US and Europe, we're thrilled to announce our upcoming...

- GFR Fund

- August 26, 2024

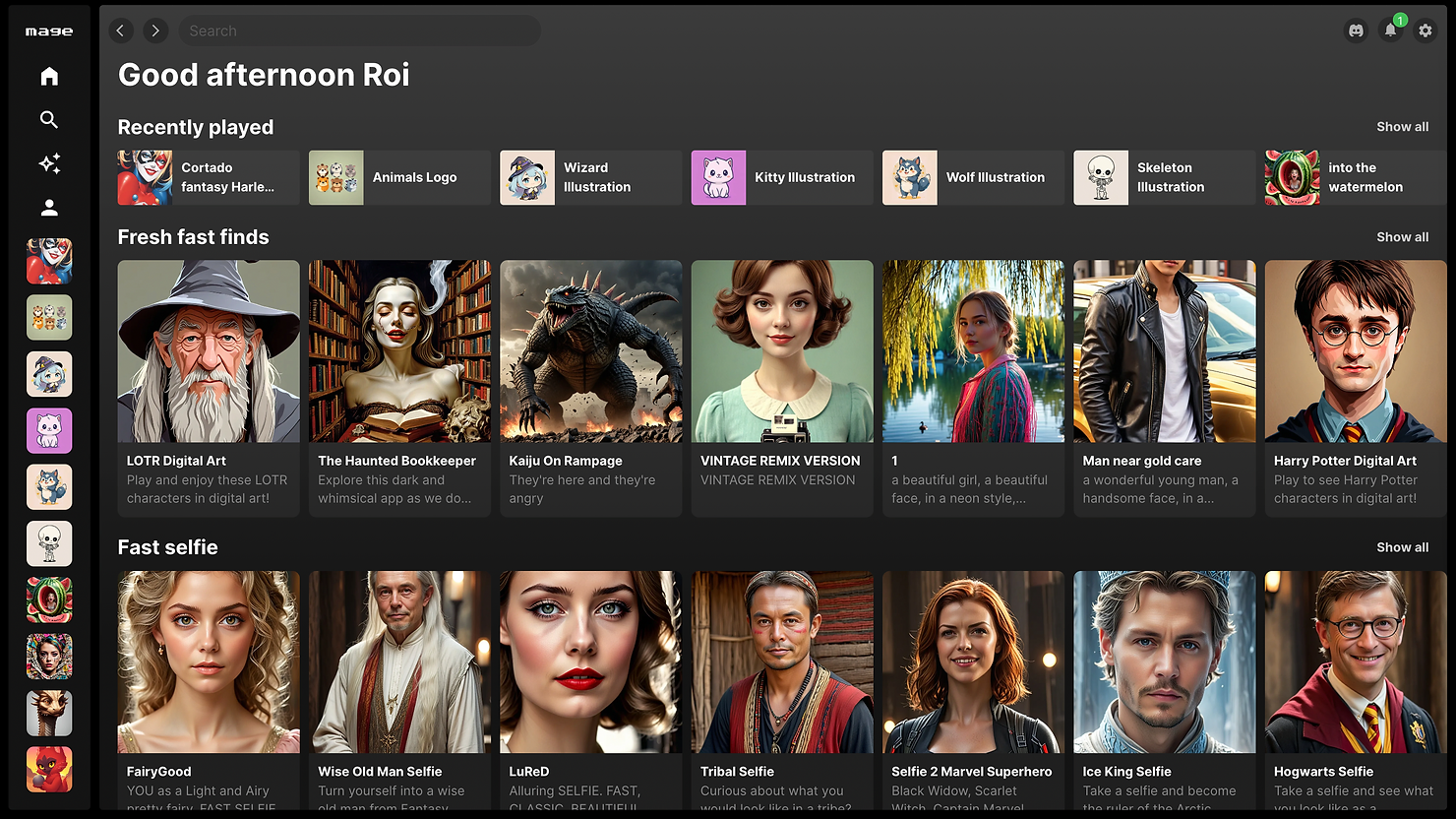

We're thrilled to announce GFR Fund's investment in Mage, an innovative platform revolutionizing how users create and...

- GFR Fund

- August 22, 2024

At GFR Fund, our investment strategy revolves around emerging digitally-native communities. We're passionate about...

- GFR Fund

- August 22, 2024

The landscape of artificial intelligence (AI) and content creation is undergoing a radical transformation. AI is not...

.png)

.jpeg)